Credit Scores and Loans

If you are reading this, you most likely know that a credit score is something that can heavily impact your life, affecting not only your ability to get loans now and in the future, but also the favorability of interest rates on loans you are offered.

Beyond this, the credit scoring bureaus, the lendors, and the other powers that be in the financial sector have conspired to make credit scoring a rather complicated system that is difficult for many consumers to grasp and keep up with.

Here, I will break the main principles down in the simplest ways I can. At the end of this post, I will also give you my reasoning for why and how you should break away from the credit system altogether, with one key exception.

Types of Scores

There are many types of credit scores. Hundreds in fact. Some are nationwide and some are maintained in-house by individual lenders and insurance agencies. The two most-commonly-used scores are the FICO Score and the VantageScore.

The FICO Score is the oldest and, generally, most popular score for use among lenders, but there are 19 main versions of this score in use today, with several less-common versions also in use by some lenders. This score was originally developed by Fair Isaac and Company, which has since been renamed to FICO.

VantageScore is a newer scoring model which was developed as a joint venture between the big three credit bureaus: Experian, Equifax, and TransUnion. Like the FICO score, it has developed into separate iterations over time. VantageScore 1.0 and VantageScore 2.0 never fully caught on with lenders following their releases because they utilized a different scoring range and system from the FICO Score that lenders have long been accustomed to. VantageScore 3.0 and the VantageScore 4.0 (the newest version of the score) utilize the same scoring range as the FICO Score in order to better meet lender needs and compete in the scoring marketplace.

You can see an overview of the score types and scoring ranges in the table below.

How the Scores are Calculated

The actual equations used to calculate the credit scores are a closely guarded secret of the companies who made them. It is, after all, these equations that make the scores what they are and provide value and income for the companies when a lender asks them to be applied to evaluate a potential borrower.

While you will never find the actual equations used to calculate the scores, you can find breakdowns of the scores into component parts to get a better idea about how any action you take will affect your credit.

Compare the interactive graphs below to see the differences in how the FICO Score and VantageScore 3.0 are weighted by their component parts.

The Problem with Credit Scoring

The main problem with credit scores in general is that they rely on constant and long-term use of debt as you can see from the weight categories shown in the graphs above. You get a higher score for consistently using moderate levels of debt over a long period of time, not for being debt free and having good income and net worth to back you up.

The scores you receive are not truly reflective of your ability to pay back the loan, but, rather, the likelihood that you will pay back a loan consistently over time and be a low-risk investment the company can bank on to provide solid returns on their investment. You see, these companies don’t like people to pay off loans quickly or stay out of debt – they don’t make money when that happens. They want you to take out a loan on your house or your car and pay only the minimum payment each month for the full length of the loan.

Let’s take a look at an example to see why lenders like this so much.

The Example: $250,000 Mortgage at 4% Interest Rate

Let’s say that you find a house you really like and it costs $312,500. In order to enter into a loan and avoid private mortgage insurance, you will need to pay at least a 20% down payment (or use an 80/20 loan, but we won’t get into that here). That 20% down payment would cost you $62,500 out of pocket, leaving you with $250,000 that you will need a loan for. A standard mortgage is a 30-year fixed-rate mortgage, and a common interest rate for this type of mortgage is 4% at time of writing.

The $250,000 you are borrowing is called your principal. When you make payments to the bank you will pay the same amount each month based on a pre-determined payment schedule called an amortization table. A portion of your payment goes to pay down the principal and the remainder of your payment goes to pay the interest, which is essentially the fee you pay the bank for using their money. The amount of interest you pay each month is based on the amount of principal left in the loan, so, over time, the amount of interest you pay goes down, while the balance you pay toward principal goes up. This essentially means that banks receive the majority of the interest up front, guaranteeing them a quick return on their investment, while you don’t get to see the balance you owe drop quickly until closer to the end of the loan life.

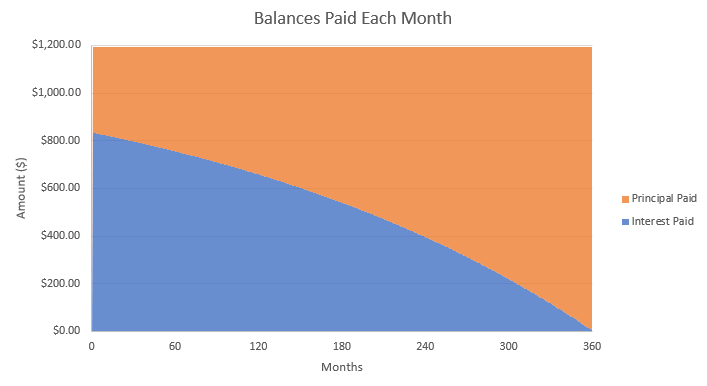

In this case, the monthly payment on this loan would be about $1,190. You can see how the principal and interest payments on this amount change over the life of the loan in the graph below.

-

Save

The chart shows the principal and interest paid each month as a sum with each color showing the portion of the total that is part of each category. This sum is the same amount every month, which is the monthly payment ($1,194). As you can see from both charts, the amount of principal paid early in the loan is small while the amount of interest paid is high. Eventually, this changes and the loan gets paid off quicker as the interest payments account for a smaller amount of each month’s total payment, but it takes a long time for this to happen. In this case, it takes about 153 months (12 years 9 months) before the amount of principal paid each month exceeds the amount of interest paid.

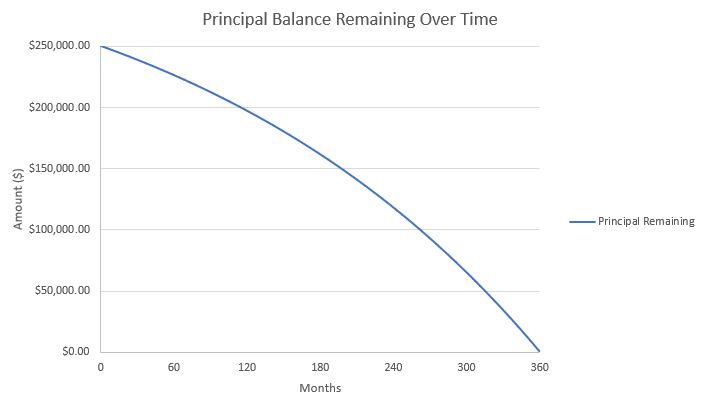

This is also reflected in the following chart showing the principal remaining over the life of the loan.

-

Save

As you can see, the loan pays off slowly at first and pays off faster and faster as the loan ages, but it is carefully constructed to terminate right at 30 years. This allows the bank to plan in advance for how much money they will make off of the loan.

Speaking of that, the key thing you need to know here is that the bank is making money off of you. In other words, over the loan’s life you will pay more money to the bank than the cost of the house alone. Sadly, this is something most people don’t consider when they sign on the dotted line.

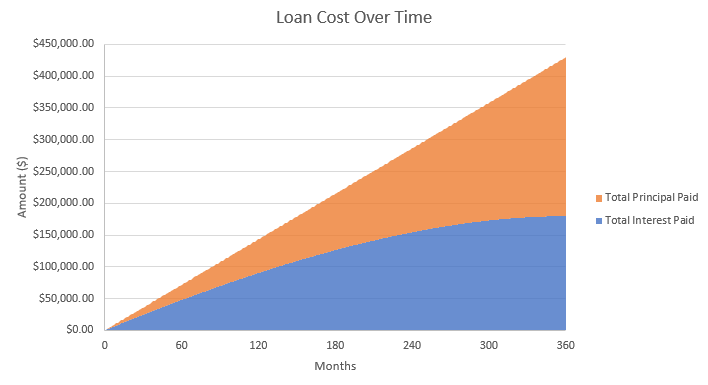

What is worse is just how much this can cost you. A 4% interest rate doesn’t sound like much, after all, but this next chart highlights just how much it affects the amount you end up paying.

-

Save

Like the first chart above, the total cost is shown as a sum over time, broken out by color into principal and interest. As you can see, the total loan cost is nearly $430,000! That’s the $250,000 in principal plus almost $180,000 in interest you will pay to the bank that doesn’t add value to your life in any way other than to let you get the house earlier. Add in the $62,500 you paid at the beginning and you ended up paying $492,500 for a $312,500 house. When you sell the house later, you’ll get back some of that value, but the cost of borrowing is clear and very high.

So What Should I Do?

We at Seven Fat Cows recommend that you focus on saving money and not borrowing. If you have existing debt, do everything you can to pay it off quickly.

As humans, we often get caught up in wanting nice things now, but we need to learn to be patient and have self-restraint on our purchases. We want a new house and new car now, but if we can’t pay cash for it then we shouldn’t do it because getting into debt will drain our future income, and can affect our future happiness.

The only exception to this rule that we condone and promote is signing up for a good cash-rewards credit card with a solid return, such as 1.5% or 2%. On this card, you should put the majority of your regular household expenditures. However, the key to this is that you must pay the card off in full every month. This way you do not pay interest on your expenditures and you aren’t living outside of your means. If you can do this effectively every month, then you will save money on spending you would have been making anyway, such as utility bills, groceries, and gas for your car.

If you are concerned you might not have the restraint to avoid impulse spending on your credit card, then we suggest you avoid the credit card altogether and stick with a debit card so you cannot outspend yourself.

-

Save